If you’re reading this, you’ve likely checked your bank balance three times today.

I get it. In the volatile economic climate we’ve navigated through late 2024 and 2025, cash flow hasn’t just been king, it’s been the emperor, the judge, and the jury. We’ve been conditioned to believe that liquidity is the only metric that matters. And yes, running out of cash is the fastest way to kill a business.

But here is the dangerous truth I am seeing in boardroom after boardroom: obsessing only with cash flow is the second-fastest way to kill a business.

It’s a slower death, often invisible until it’s too late. It is a death by stagnation, talent exodus, and irrelevance. As we settle into 2026, the leaders who will thrive are not the ones hoarding cash in fear, but the ones brave enough to invest in value.

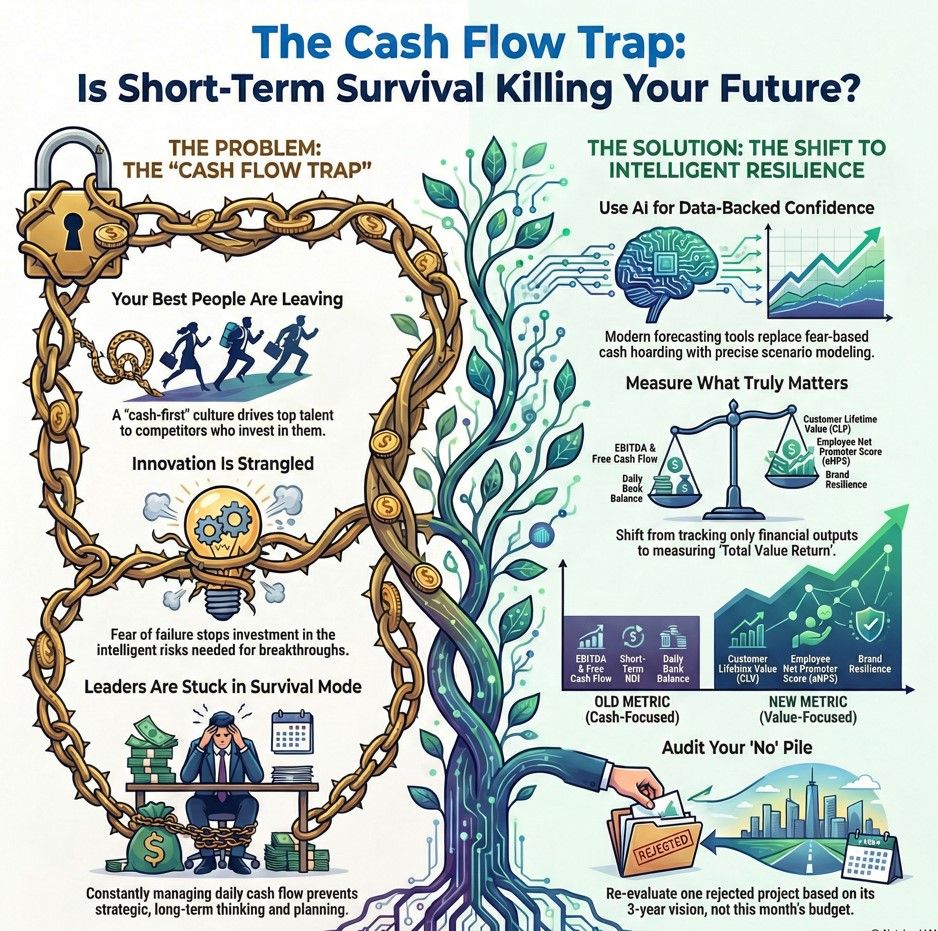

Here is why the "Cash Flow Trap" is so dangerous right now, and how you can shift your leadership mindset to build true resilience.

1. The Landscape: The High Cost of "Impatient Capital"

We are currently living through an era of "Impatient Capital." The economic volatility of the last two years forced many small business owners into a defensive crouch. We stopped playing to win and started playing not to lose.

The problem? This defensive posture has morphed into a permanent strategy.

Recent analysis from late 2025 highlights a worrying trend: businesses are increasingly prioritizing short-term liquidity over long-term viability. This "short-termism" is eroding competitive edges. When you make every decision based solely on “Will this pay off in 30 days?”, you automatically disqualify the strategies that build dynasties: brand equity, deep R&D, and employee culture.

We are seeing a "leadership bandwidth" crisis. Executives are so consumed by immediate financial fires, supply chain hiccups, inflationary remnants, that they have stopped looking at the horizon. They are reactive, not strategic. This isn't just a financial issue; it's a cognitive one. You cannot innovate when your brain is stuck in survival mode.

Coach’s Insight: Ask yourself, are you managing a business, or are you just managing a bank account? If your strategic planning meeting is just a review of accounts receivable, you are in the trap.

2. The Hidden Damage: What You Lose When You Chase Pennies

The impact of this tunnel vision is already hitting the data.

- The Talent Drain: In 2026, top-tier talent is craving stability and purpose, not just a paycheck. A "cash-first" culture often manifests as wage freezes, cut benefits, or a lack of professional development. The result? Your best people leave for competitors who invest in their future. Recent workforce studies suggest that businesses prioritizing financial stability for their employees, not just the company account, are seeing higher retention rates.

- The "Optics Over Outcomes" Trap: We are seeing a rise in "greenwashing" and superficial improvements. Businesses cut deep strategic initiatives (like genuine sustainability overhauls or digital transformation) in favor of cheap marketing tricks that offer a quick, but fleeting, ROI. This destroys consumer trust.

- Innovation Paralysis: You cannot A/B test your way to a breakthrough if you're afraid to lose $1,000. True innovation requires the "right kind of wrong", intelligent failures that yield data. "Cash-flow-obsessed" leaders view all failure as waste, effectively strangling innovation in the crib.

3. The Shift: From Survival to Intelligent Resilience

So, how do we break free? The good news is that the toolkit for 2026 is better than ever.

Leverage AI for Confidence, Not Just Efficiency The most exciting development in the last six months is the maturation of AI-driven financial forecasting. We are moving past "gut feeling" management. New dynamic forecasting tools allow leaders to model scenarios with incredible precision, turning cash flow from a scary monster into a manageable data point.

- The Impact: When you know your cash position with data-backed confidence, you stop hoarding out of fear. You regain the psychological safety needed to make bold investments.

Embrace "Total Value Return" The most successful leaders I coach are shifting their KPI dashboards. They aren't just tracking EBITDA or free cash flow; they are tracking "Total Value Return." This includes:

- Employee Net Promoter Score (eNPS): Is your team an asset that is appreciating or depreciating?

- Customer Lifetime Value (CLV): Are you sacrificing long-term loyalty for a quick sale today?

- Brand Resilience: Studies from late 2025 show that brand equity acts as a buffer during downturns. It is an asset you must feed.

4. Future Outlook: The Next 5 Years

Looking ahead to 2030, the divide between the "Hoarders" and the "Builders" will widen.

- Regulatory Pressure: Governments are cracking down on short-termism, especially regarding climate and sustainability. Companies that delayed green investments to save cash in 2025 will face massive compliance costs in 2027.

- The Resilience Premium: The market will reward "antifragile" businesses, those that can withstand shocks not because they have a pile of cash, but because they have loyal customers and agile systems.

- The Human Element: As AI commoditizes execution, culture becomes your only unique moat. You cannot build a world-class culture on a shoestring budget.

The Verdict

Cash flow buys you time. That is it. It does not buy you loyalty, it does not buy you innovation, and it certainly does not buy you a legacy.

You need oxygen (cash) to survive, but if all you do is breathe, you aren't really living.

Your Next Step: This week, I want you to audit your "No" pile. Look at the last three initiatives you rejected purely due to cash flow concerns. Re-evaluate them not through the lens of “Can we afford this this month?” but “Can we afford NOT to do this for our 3-year vision?” Pick one low-risk, high-reward investment you’ve been putting off, a training program, a software upgrade, a brand refresh, and approve it. Signal to yourself and your team that you are back in the business of building.

Images done in NotebookLM and Gemini