The Most Expensive Decision You'll Make This Decade

I’ve seen more companies bleed cash, lose market share, and damage their brands over one decision than any other. It’s not R&D. It’s not marketing. It’s the fundamental, bet-the-company choice: do we "make" or do we "buy"?

For decades, this was a simple calculation. A finance team ran the numbers, and the cheapest option won. But in today's world—and especially here at the end of 2025—that model is not just obsolete; it's dangerous. We no longer operate in a stable, globalised system. We operate in a world defined by geopolitical fractures, sudden tariff wars, and binding ESG Commitments.

The 2020-2024 period taught leaders a painful lesson: a 10 cent per unit savings is worthless when your product is stuck on a ship for six months, your single-source supplier is locked down, or a geopolitical conflict severs your critical shipping lane. This reality has forced a complete re-evaluation. The primary driver of the "make vs. buy" analysis has shifted from pure efficiency (the lowest possible cost) to resilience (the highest possible predictability). This is the real, data-driven force behind the "reshoring" trend—it's not a political slogan, but a C-suite-level risk mitigation strategy to flee supply chain disruptions.

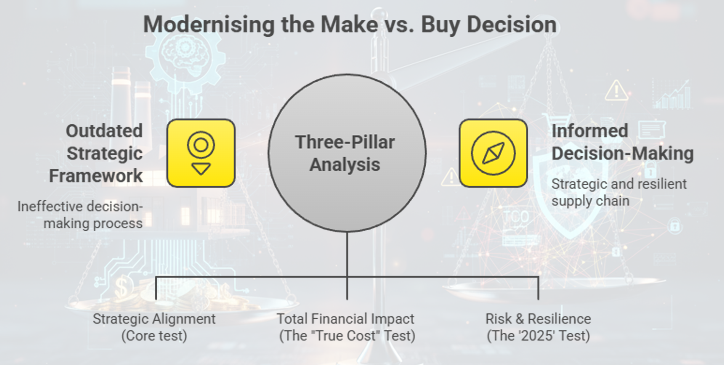

The Goal in this 5 part series is to give you a modern framework to navigate this decision. Moving this choice from a simple spreadsheet to a robust, three-dimensional strategic analysis.

Foundational Clarity: Are You an Innovator, a Marketer, or a Manufacturer?

Before we can analyse, we must define the terms. The first mistake I see leaders make is confusing their options. Choosing the wrong model at the start guarantees failure.

- Contract Manufacturing (CM): This is the 'Buy' (Your Product) model. You, the company, provide the unique design, proprietary formulation, and detailed specifications. The Contract Manufacturer is your hired factory, leveraging their expertise and facilities to produce your proprietary product. This model is ideal for businesses seeking "unique, differentiated products." The classic example is Apple: they design the iPhone (their intellectual property), and Foxconn (the CM) assembles it to their exact standards.

- Private Label: This is the 'Buy' (Their Product) model. The manufacturer already has an existing product or a catalog of products. You select one, and they put your brand on it. This is the model for "faster market entry" and "companies focused on branding." A grocery chain, for instance, doesn't design a new coffee bean; it selects a blend from a large roaster and sells it under its "store brand."

The choice between Contract Manufacturing and Private Label is not a manufacturing decision; it's a business model decision. The research shows a clear split: CM is for customization and protecting your intellectual property, while Private Label is for branding and convenience. This means a leader must first identify their company's core competency. If your advantage is product innovation and R&D, you must use Contract Manufacturing. If your advantage is marketing, branding, and customer acquisition, Private Label is a faster, more capital-efficient path. You cannot be an innovator using a Private Label model, as you have no control over the product's design.

This series will focus on the more complex, strategic choice: Own Manufacturing (Make) vs. Contract Manufacturing (Buy).

A Modern Framework for the 'Make vs. Buy' Decision

To make this decision correctly in the late 2025 landscape, we must adapt the classic strategic framework. You must analyse three pillars, and you must do it in this order.

Pillar 1: Strategic Alignment (The 'Core' Test)

This is the first and most important filter. You must ask: "Does this manufacturing activity touch our Core Competency?"

A core competency is not just something you're good at. It's the "deep proficiency that enables a company to deliver unique value to customers." It is the "roots out of which businesses grow," your true, defensible competitive advantage, be it innovation, quality, or a unique process technology.

Never, ever outsource your core competency. If your unique, patented manufacturing process is what makes your product superior, you must "make" it. Outsourcing that activity is, quite literally, training your future competitor.

In Contrast, if the component is a commodity—non-strategic, with many suppliers available—you should almost always "buy" it. This allows you to "focus on core competencies." Wasting precious capital and management focus on "making" a commodity part is a profound strategic error.

Pillar 2: Total Financial Impact (The 'True Cost' Test)

This pillar moves us beyond the "unit price" trap.

- If you "Make": This is a Capital Expenditure (CapEx) decision. You must analyze the "high initial investment requirements." This is a full-blown financial case, analyzing your Capex ratio (Operating Cash / Capex) and the project's long-term manufacturing Capex, Net Present Value (NPV), and payback period for the new plant and equipment.

- If you "Buy": This is a Total Cost of Ownership (TCO) decision. TCO is the "total cost of acquiring, using, managing, and withdrawing an asset over its entire life cycle." You must quantify not just the supplier's invoice, but all the hidden costs: management overhead, shipping, tariffs, import duties, and quality rework. (We will dive deep into this TCO iceberg in Part 4).

This analysis reveals a critical truth: The "Make" decision is a bet on your future, requiring high upfront Capex for a long-term return. The "Buy" decision is an optimisation of your present, offering lower Capex but exposing you to variable and often-hidden total costs.

Pillar 3: Risk & Resilience (The '2025' Test)

This is the modern tie-breaker. The classic framework called this "risk"; I call it "resilience." This pillar analyzes qualitative factors that have massive quantitative impacts.

The key questions are: How sensitive is your intellectual property? How critical is 100% control over quality? And most importantly: What is the real cost of a disruption?

In the 2025 landscape—defined by persistent geopolitical tensions, trade re-alignment, and fragile, over-extended supply chains—a "buy" decision is now an explicit risk-management decision. For many companies, the risk of their global supply line being cut has finally become a higher, more tangible cost than building a new domestic factory.

In the following parts of this series, I will use these three pillars to analyse the "Make" and "Buy" cases in detail, giving you the tools to make the right choice for your business.