Resilience Trumps Efficiency

We've reached the end of the "Make vs. Buy Decision" series. For the last 30 years, the winner in manufacturing was the leader who built the cheapest supply chain. For the next 30, the winner will be the one who builds the most resilient one.

The 'make vs. buy' decision at the end of 2025 is no longer a simple binary. The "old playbook" of pure cost-efficiency is being replaced by "agile, resilient models." The smartest companies are rejecting this "either/or" choice. Instead, they are building "make and buy" hybrid models explicitly designed to thrive in a new, volatile, and fragmented world. This final post will show you how to build your strategy.

The New Playing Field:

The Three Forces Redefining "Make vs. Buy"

You cannot make a 2025 decision using a 2005 framework. Three massive forces have fundamentally changed the "make vs. buy" calculation.

Force 1: Geopolitical Shock & Fragmentation

The era of predictable, "flat world" globalisation is over. The new normal for every supply chain leader is "geopolitical instability," "trade conflicts," tariff uncertainty, and "unrest in shipping chokepoints" like the Red Sea and Suez Canal. This has shifted the core of strategy from "producing in the cheapest country" to "producing where it's safest."

Force 2: The Data-Driven Reshoring Wave

"Reshoring" is not just a media narrative; it's a data-backed, boardroom-level trend.

- The Proof: The 2025 USA Reshoring Survey provided stunning clarity. It found that 59% of shops, are actively reshoring, or are currently quoting reshoring projects.

- The 'Why': This is the most critical part. The top drivers are not politics. They are business drivers: This data proves that leaders are finally using a true Total Cost of Ownership (TCO) analysis, as we discussed in Part 4. They have realised, through painful experience, that the "hidden costs" of offshoring (rework, delays, disruption) are often higher than the "price" savings.

Force 3: The ESG Mandate

Environmental, Social, and Governance (ESG) is no longer a "nice to have" report. It is a new, powerful variable in the decision matrix.

- The Drivers: Regulators, investors, and consumers are all applying pressure. The Manufacturing ESG Maturity Benchmark Study 2024–2025 highlights "heightened regulatory scrutiny" from frameworks like the Corporate Sustainability Reporting Directive (CSRD). Investors use ESG Maturity, and consumers are voting with their wallets. "46% of consumers say they are buying more sustainable products.

It is far easier to manage ESG requirements in an in-house, domestic factory.

This ESG pressure is a new, powerful thumb on the scale for the "make" or "nearshore-buy" decision.

The Rise of the Hybrid:

Your 2025 / 2026 Manufacturing Strategy

Given these new forces, the smartest strategy for late 2025 is a diversified hybrid model.

- "China Plus One": This is the most popular strategy. Don't necessarily abandon China, its scale is unmatched, but diversify by adding a "Plus One" source. This "supplier + 1" strategy is your hedge against disruption.

- Nearshoring & "Friend-Shoring": That "Plus One" is often in a "nearshore" location or a "friend-shore" location (a nation with stable, aligned geopolitical ties).

This leads to my core recommendation: The "Make AND Buy" Portfolio.

Treat your manufacturing strategy like a financial portfolio. You don't put 100% of your money in one stock, so why put 100% of your production in one factory or one country?

- "Make" (In-House): This is your "blue-chip stock." Use this for your most critical, high-IP, "crown jewel" components. This is your anchor for quality and innovation.

- "Buy" (Nearshore/Friend-Shore): This is your "bond." Use this for high-volume, strategic components. It's not the cheapest, but it is stable and resilient. This is your "China Plus One" partner in Mexico, for example.

- "Buy" (Global Low-Cost): This is your "high-risk/high-reward" asset. Use this only for your most commoditised, high-labor, low-IP parts where you can tolerate disruption and a pure-price TCO still makes sense.

Your Final Tool:

The Strategic Decision Matrix

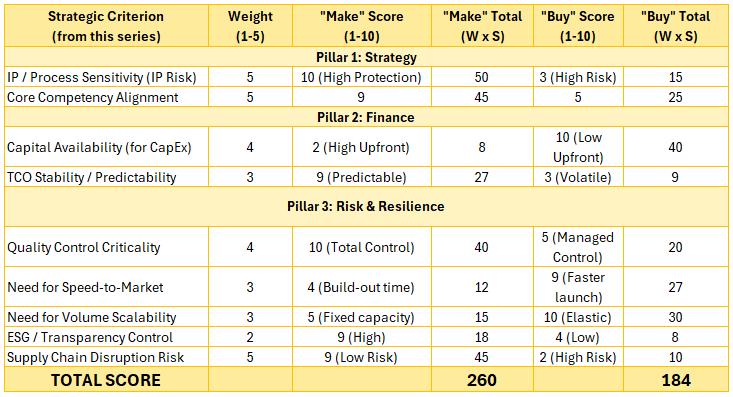

To operationalise this entire series, I leave you with one final tool. This is a "weighted decision matrix." It provides an objective, data-driven way to answer the "make vs. buy" question for any component, removing emotional bias.

How to Use:

- For the product / component you are analysing, assign a "Weight" (1=Not Important, 5=Critically Important) to each criteria based on your business goals.

- "Score" (1-10) how well "Make" or "Buy" delivers on that criteria.

- Multiply Weight x Score to get the total for each cell.

- Sum the totals. The highest score wins.

Actionable Tool: The 'Make vs. Buy' Strategic Decision Matrix

In this example, for a high-IP, high-quality, high-risk component (Total Score: 260 vs 184), the "Make" decision is the clear strategic winner, despite the "Buy" option being better on capital and scalability. This matrix forces you to make a strategic decision, not just a financial one.

The "make vs. buy" decision is a live, dynamic process, not a one-time event. Use this framework. Re-evaluate it every year as the world changes. And build for resilience.

That is how you win in late 2025 and beyond.

The full series: